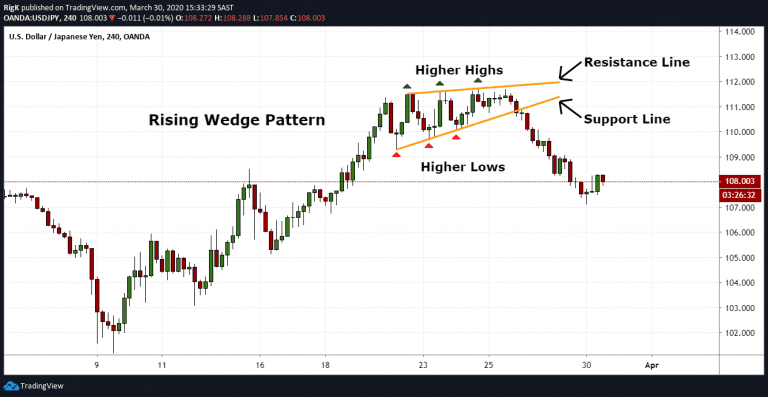

If it is bullish, the pattern is the ascending triangle if it is bearish, it is the rising wedge.Īnother approach to differentiate between the two is when one pays attention to both patterns’ volume. Also, one can confirm the pattern by noticing the trend that follows the pattern. The slope in the case of the rising wedge is upward-pointing, while in the case of the ascending triangle, it is instead a straight line, and it is the bottom line that is approaching the convergence line.

First, one can look at the pattern and acknowledge the slope of the resistance line or the upward line of the pattern.

BULLISH RISING WEDGE PATTERN HOW TO

If you are new to trading, it becomes essential to understand how to differentiate these patterns. One indicates a potential exit opportunity from the market, while the other indicates an entry point. However, what they indicate is entirely contrary. However, looking for any further changes in the market is still suggested.Īs mentioned before, differentiating between the rising wedge and the ascending triangle patterns can be confusing due to their similar looks and uncommon use amongst traders. Instead, there will be a downtrend, and the sellers can pull up their socks to reach their selling targets. But it can be beneficial because once successfully spotted, there is no need to confirm the downtrend, like any other indicator. Not all traders are well versed in plotting a rising wedge in the price chart, as it is not commonly used. Whichever the case is, the result of a rising wedge is the following downtrend. However, this trend could signify a previous downtrend or a reversal trend if it was an upward or bullish trend before the rising wedge pattern appeared. This positive inclination is a signal of an upcoming bearish trend.

One must understand that this rising wedge is indicated when the resultant angle points upwards. It is plotted by drawing two lines, one joining the highs and the other joining the lows, creating an angle when they meet.

0 kommentar(er)

0 kommentar(er)